How Assets Pass at Death

Three Ways that Property Passes

In the context of estate planning, it is important to understand the overlap in areas of the law that affect the disposition of one’s property on their death. Generally, distributions of property at death fall into three categories. Understanding this provides foundation to creating and maintaining an estate plan. Coordinating property and assets with the legal instruments is key to creating an effective plan.

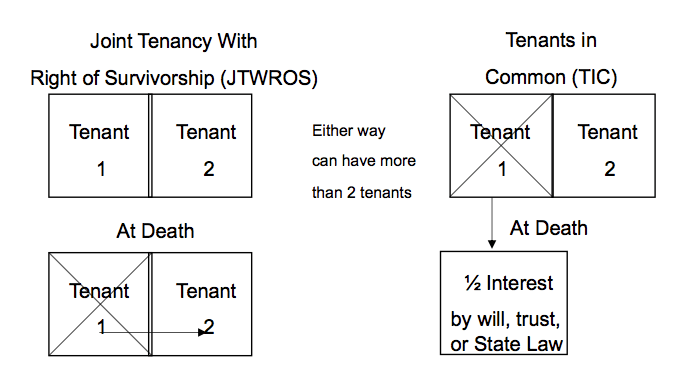

The first way that property passes at death is by Property Law. In the diagram below as illustrated, when two or more persons own property as Joint Tenants with the Right of Survivorship (JTWROS), and one of those co-owners dies, the surviving owner(s) automatically receive ownership of the deceased owner’s share. Contrast this with owning property as Tennant in Common. As the diagram illustrates, if a co-owner of property as a tenant in common dies, that deceased person’s interest goes where s/he directs by will or trust or by state law. Typically we think of Joint Tenancy when in the context of real property, and between spouses. However, the principles apply with joint bank accounts, and other property interests owned jointly.

Depending on the way property is owned by two or more owners can have tax implications and can change the effectiveness of an estate plan.

1. By Property Law

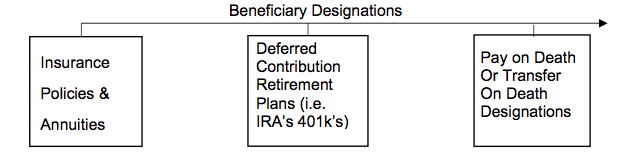

The second way that property may pass is by way of Contract Law – specifically by Beneficiary Designation. Here, an owner of a property interest entered into a contract with a company prior to his or her death for the company to transfer the benefit of the property interest to another upon his or her death. Companies can and will rely on the terms of a contract such as a beneficiary designation form when transferring property interest to another upon a death, even if the transfer conflicts with a person’s will or trust. Please note the different issues with using beneficiary designations.

2. By Contract Law – Beneficiary Designations

©DS 2020

Issues That Can Arise With Beneficiary Designations

- Decedent did not keep up to date – flat wrong

- Decedent’s asset passes outright – decedent typically loses control 2-4 weeks after death. Beneficiary inheritance subject to creditor claims, divorce.

- Beneficiary is too young (<18) or incapacitated, could cause damaging court process which could lead to loss of benefits.

- Beneficiary is old enough to inherit but too young to manage

- Beneficiary is “too old”. Beneficiary is unable to manage and may be vulnerable to fraud or “family loans”.

The third general way the property passes after someone dies is by direction of that person’s will, trust, or in the event that the deceased person does not have a will or trust, by state law (see Glossary for “Intestate”).

3. By Will, Trust, or State Law

Understanding how property can pass when someone dies is foundational to building an effective estate plan. Coordinating the overlap in both property ownership and the laws in effect is vital to making sure that everything is planned for appropriately. Here at Davis Schilken, PC, we work to help you understand how the law affects each asset that you own, and how to optimally plan for how you want your property to pass when someone dies. If you are interested in speaking to one of our attorneys about this, give our offices a call today at (303) 670-9855.